Understanding Mutual Fund NAV: A Comprehensive Guide

Investing in mutual funds is a smart way to make your money grow, but it’s important to know how they work. One key idea you need to understand is called Net Asset Value (NAV). In this blog, we’ll explain what NAV means, how it is calculated, and why it’s important for you as an investor. Whether you are just starting out or already know a bit about finance, this guide will help you learn the basics of understanding mutual fund NAV in easy words.

What is Net Asset Value (NAV)?

NAV, which stands for Net Asset Value, is the price you pay to buy or sell a part of a mutual fund. It shows how much all the things the fund owns are worth, like stocks and bonds, after taking away what it owes. To find the NAV, you take the total value of everything the fund has, subtract any debts, and then divide that number by how many parts (or units) are available. You can think of NAV as the price tag on your investment in the mutual fund. This is important for understanding mutual fund NAV!

Why is NAV Important?

- Performance Indicator: NAV is like a scorecard that shows how well a mutual fund is doing over time.

- Investment Decisions: It helps investors figure out the best times to buy or sell their parts in a mutual fund.

- Transparency: When NAV is updated regularly, it gives clear information about how much the fund is worth and how well it’s performing. This is important for understanding mutual fund NAV!

How is NAV Calculated?

The formula for calculating NAV is simple:

Components of NAV Calculation

- Total Assets: This includes:

- Market Value of Securities: This is the current worth of things like stocks and bonds that the fund owns.

- Cash and Cash Equivalents: This is any cash the fund has that can be easily turned into cash when needed.

2.Total Liabilities: This includes:

- Operating Expenses: These are the costs of running the fund, like fees for managers and other expenses.

- Other Liabilities: This is any money the fund still needs to pay or other debts it has. Understanding mutual fund NAV means knowing these parts!

Example Calculation

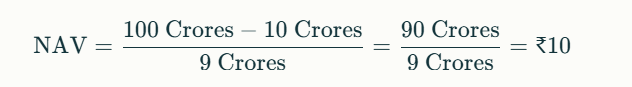

Let’s say a mutual fund has:

Total Assets worth ₹100

CroresTotal Liabilities of ₹10

CroresTotal Outstanding

Units of 9 Crores

Using the formula:

This means each unit of the mutual fund is worth ₹10. Understanding mutual fund NAV helps you see how much each part of the fund is worth!

How Does NAV Change?

NAV changes every day because it depends on how much the things in the fund are worth in the market. For example, if the stocks that the fund owns go up in value, the NAV will go up too. But if those stocks lose value, then the NAV will go down. This is important for understanding mutual fund NAV because it shows how your investment can change over time!

Daily Updates

Mutual funds usually share their NAVs every day after the stock market closes, which is around 3:30 PM IST. This way, investors can see the latest information and make smart choices about their investments. Understanding mutual fund NAV helps you know exactly how much your investment is worth at any time!

Factors Affecting NAV

Several things can change the NAV of a mutual fund:

- Market Conditions: When stock prices go up or down, it directly affects how much the fund’s assets are worth.

- Fund Performance: How well the investments in the fund are doing also impacts its value. If they do well, the NAV goes up; if they don’t, the NAV goes down.

- Expenses: If the fund has high costs to run it, these costs are taken out from the total value. This can lower the NAV. Understanding mutual fund NAV means knowing how these factors can affect your investment!

How to Use NAV for Investment Decisions

- Buying Units: When you put money into a mutual fund, you buy units at the current NAV. For example, if you invest ₹10,000 in a fund with an NAV of ₹100, you will get 100 units of that fund.

- Tracking Performance: You should keep an eye on how the NAV changes over time. This helps you see how well your investment is doing.

- Comparing Funds: You can use NAV to compare different mutual funds. Instead of just looking at their current prices, check how their NAV has changed in the past. Understanding mutual fund NAV helps you make better choices about where to invest your money!

Conclusion

Understanding Net Asset Value (NAV) is very important for anyone who wants to invest in mutual funds. It helps you see how well your investment is doing and makes it easier to decide when to buy or sell your units. By paying attention to NAV and knowing what it includes, you can feel more sure about your investment choices. This is all part of understanding mutual fund NAV, which can help you on your journey to grow your money!