Crunching the Numbers: India’s Snack Tax Hike to 18%

Hello, Finance Enthusiasts!

Today, we’re diving into a topic that’s crunchy on the outside but has serious implications on the inside – the recent hike in the Goods and Services Tax (GST) on snacks in India. Whether you’re a student saving up your pocket money for a packet of chips or a professional crunching numbers as well as snacks, this change affects us all. So, let’s break it down in a way that’s as easy to digest as your favorite light bites!

A Snack-Sized Background

The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It’s like a relay race where the tax baton is passed from the raw material stage right up to the final sale to you, the consumer.

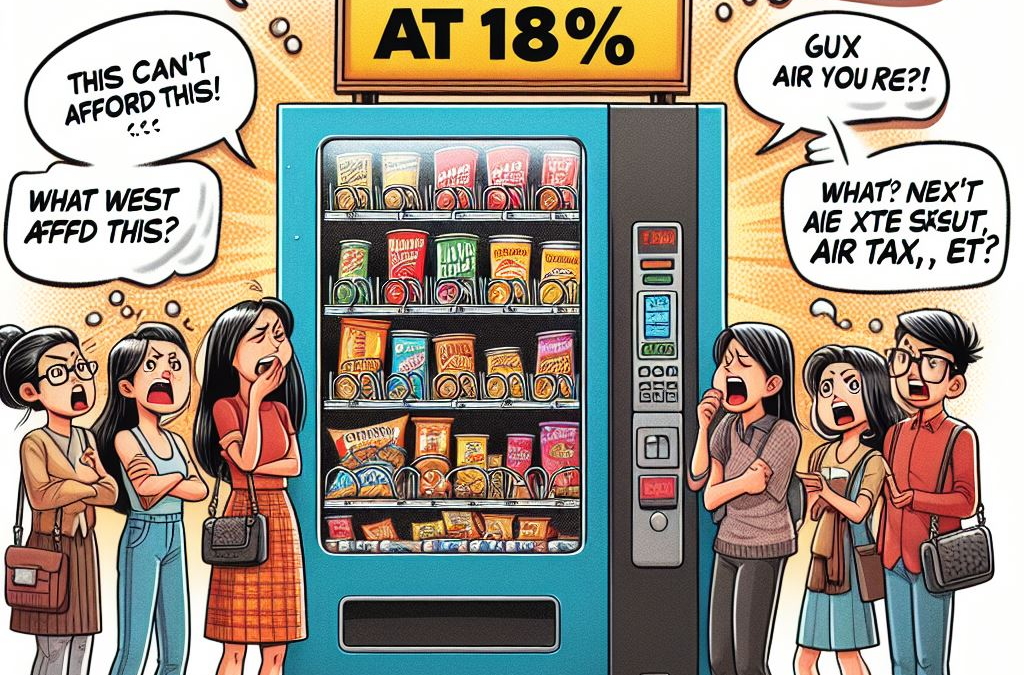

The Big Crunch: Tax on Snacks Raised to 18%

Recently, there’s been a stir in the snack aisle. The tax authorities have decided that certain snacks will now be taxed at 18% instead of the previous 12%. This decision has caused quite a debate between food firms and the GST authority. The crux of the matter? A distinction between extruded (think puffed snacks) and non-extruded snacks (like traditional potato chips).

What Does This Mean for You?

If you’re wondering how this affects your wallet, here’s the scoop. The increase in tax means that the cost of producing snacks goes up. And when production costs rise, often, so do the prices on the shelves. In simple terms, your favorite munchies might just get a tad more expensive.

The Silver Lining

But it’s not all gloomy! The tax collected goes towards building a better nation. It funds infrastructure, education, and healthcare services. So, while we might grumble about the extra pennies spent, they’re working towards a brighter future for all of us.

Navigating the Snack Tax Maze

Understanding the ins and outs of GST can be as tricky as opening a snack packet quietly in a movie theater. But fear not! Here’s a simple way to look at it:

- Nil GST: Fresh fruits and veggies, milk, and more.

- 5% GST: Packaged food items like dried legumes, buttermilk, and more.

- 12% GST: Preserved items using sugar or vinegar.

- 18% GST: Our current hot potato, the ready-to-eat snacks.

A Bite-Sized Conclusion

In the end, taxes are a part of our daily lives, just like snacks. They might leave a salty aftertaste at times, but they’re essential for the growth of our country. So, the next time you reach for that packet of chips, remember, you’re not just snacking; you’re contributing to the nation’s development!

Stay informed, stay savvy, and keep crunching – both numbers and snacks!

I hope this blog helps you understand the recent tax changes in a simple and relatable manner. If you’re keen on getting into the nitty-gritty of GST and its impact on various sectors, stay tuned for more bite-sized finance wisdom!

Electric Vehicle Tax Credit: India's Policy Insights

[…] Stay tuned, stay informed, and let’s drive towards a sustainable future together! […]