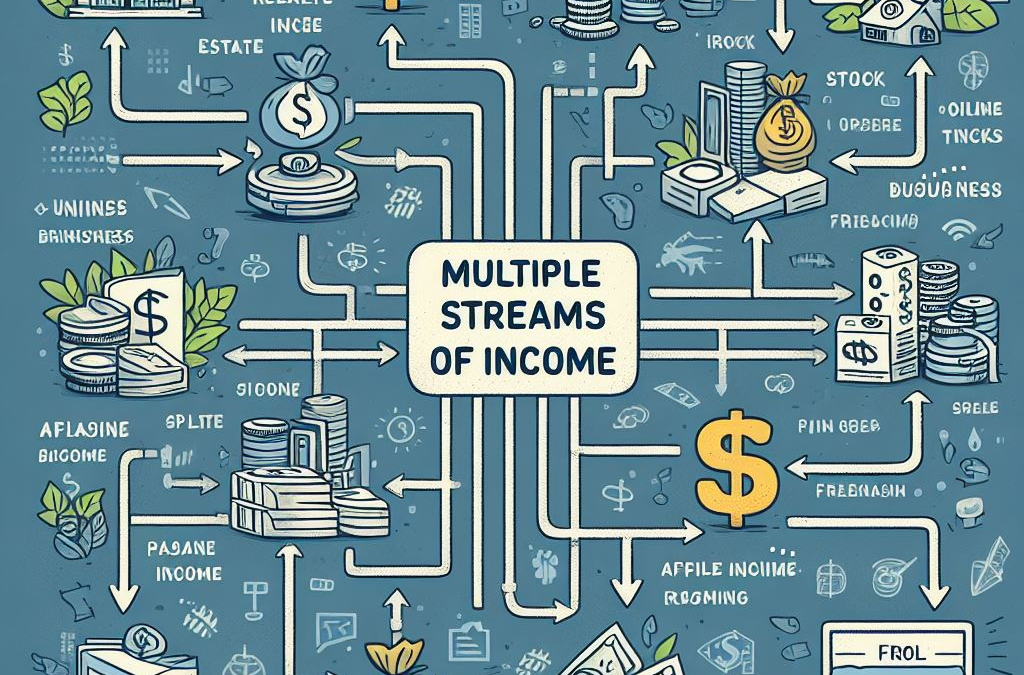

Mastering the Art of Creating Multiple Streams of Income

Imagine building a strong castle with many walls to protect it from storms. That’s kind of like what creating multiple streams of income is all about. It’s not just about saving your money or spending less. It’s about having different ways to make money, like having different doors to your castle. This isn’t just a backup plan when things get tough. It’s like having your own magic key to unlock the doors to financial freedom.

Table of Contents

- Understanding the Concept of Multiple Income Streams

- The Importance of Diversified Income

- Opportunities for Creating Multiple Streams of Income

- Common Mistakes to Avoid

- Steps to Building Multiple Income Streams

- How to Master One Revenue Stream

- Avoid the Pitfall of Comparing Incomes

- Beware of Negatively Impacting Other Income Sources

- Shiny Object Syndrome: A Real Threat

- Passive Income Isn’t Always Passive

- Responsibilities that Come with Multiple Income Streams

- Final Thoughts

Understanding the Concept of Multiple Income Streams

Think of it like having more than one tap for water in your house. When we talk about “multiple streams of income,” it just means having money coming in from different places, not just one. So, let’s say you have your main job, like your dad or mom going to work. That’s like the big tap in your bathroom that gives you most of your water. But then, let’s say you also do something extra, like selling lemonade on weekends. That’s like having a little tap outside that gives you some extra water too. Having these different taps means you’re not only relying on one source for all your money.

The Importance of Diversified Income

Imagine you’re playing a game and you have more than one life. That’s kind of like having multiple streams of income. If something bad happens, like losing your job or when everything gets tough, having another way to make money can help you stay afloat. Plus, it’s like having a speed boost in a game – you can save money faster and reach your goals, like buying cool stuff or starting your own business, much quicker.

Opportunities for Creating Multiple Streams of Income

Think of it like having different tools in your toolbox. Here are some cool ways to make money:

- Rental Properties: It’s like owning a mini hotel! You rent out your house or apartment to people and they pay you every month to stay there.

- Stock Market: This one’s like planting seeds in a garden. You buy little pieces of companies (like LEGO or your favorite video game company) and as they grow, they give you some of their profits!

- Online Business: Ever thought of having your own store but online? You can sell stuff like toys, clothes, or even your own creations, and people buy them from your website!

- Freelance Work: It’s like being a superhero with a special power! You can use your skills, like drawing or writing, to help others and they pay you for it.

With these different ways, you’re not putting all your eggs in one basket. Instead, you’re like a superhero with lots of tools to help you save the day and make some extra money!

Common Mistakes to Avoid

While creating multiple income sources can be rewarding, it’s important to avoid common pitfalls. Here are some mistakes to steer clear of:

- Stick to What You Know: Before trying to make money in lots of different ways, make sure you’re really good at one thing first.

- Don’t Compare Yourself: Everyone’s different, so don’t worry about how much money others are making. Focus on what works best for you!

- Don’t Forget What’s Working: If you’re already making money from something, don’t mess it up by trying something new that might not work out.

- Stay Focused: Don’t get distracted by every new way to make money. Stick to the things you’re good at and enjoy doing.

- Know What You’re Getting Into: Some ways to make money, like renting out a house or investing in stocks, need a bit of work and money upfront. And having lots of different ways to make money means lots of things to keep track of, so be ready for that!

By avoiding these mistakes, you can make sure your journey to making money in different ways goes smoothly.

Steps to Building Multiple Income Streams

Here are some steps to help you build multiple income streams:

- Know What You’re Good at and What You Like: Think about what you’re good at and what you love doing. Making money doing something you enjoy is awesome!

- Find Out What People Want: Look around and see what people need or want. If lots of people want something, it’s a good idea to try making money from it.

- Start with Baby Steps: You don’t have to do everything all at once. Start with something small, like selling lemonade or doing chores for neighbors. Learn from what you do and then try more things when you’re ready.

How to Master One Revenue Stream

Before you try making money in lots of different ways, it’s important to get really good at one thing first. Maybe it’s your regular job or something you do on the side. Get really good at it, learn all about it, and use that knowledge to help you make money in other ways later on. It’s like building a strong base for a big Lego tower!

Avoid the Pitfall of Comparing Incomes

It’s totally normal to look at how much money other people are making and compare it to yours. But here’s the thing: everyone’s money story is different. Instead of worrying about what others have, focus on your own goals and how you can reach them. Take your time and go at your own speed. You’ll get there in your own awesome way!

Beware of Negatively Impacting Other Income Sources

When you’re checking out new ways to make money, that’s awesome! But remember, don’t let them mess up the ways you’re already making money. Each way you make money needs some of your time and effort. If you try to do too many things at once, you might not do any of them well. So, be careful not to spread yourself too thin!

Shiny Object Syndrome: A Real Threat

Ever heard of shiny object syndrome? It’s when you get easily distracted by new ways to make money and forget about what you’re already doing. Instead of chasing every shiny new idea, stick to the ones that match what you’re good at and what you want to achieve in the long run. That way, you’ll stay on track to reach your goals without getting sidetracked by every new thing that comes your way!

Passive Income Isn’t Always Passive

It’s like making money while you’re chilling. But here’s the thing – even though it’s supposed to be easy, things like renting out houses or owning stocks that pay you dividends still need a bit of looking after. So, even though you’re not working hard for it all the time, you still need to keep an eye on things to make sure everything’s running smoothly.

Responsibilities that Come with Multiple Income Streams

When you start making money in different ways, you also get more stuff to do. You’ll have to keep track of how much money you’re making, how much you’re spending, and deal with taxes for each way you make money. It can get pretty busy! But don’t worry, you can get some help from a money expert or use special tools to keep everything organized. That way, you can focus on making more money without getting overwhelmed by all the paperwork!

Final Thoughts

Making money in different ways! But here’s the thing – it’s not just about getting rich quick. It takes planning, hard work, and making smart choices. The idea is to make sure you’re not just making money, but also making sure you’re secure and happy with your money in the future. So, keep working smart and building your money castle!

Tax Deductions Explained: Maximize Savings in India - Wealth Yatra

[…] India’s tax maze can be daunting. But fear not! In this blog, we’re breaking down tax deductions explained in the simplest way possible, so even your kid brother can grasp it. Get ready to unlock the power […]